Cra Remittance Form 2011-2026

What is the PD7A Form?

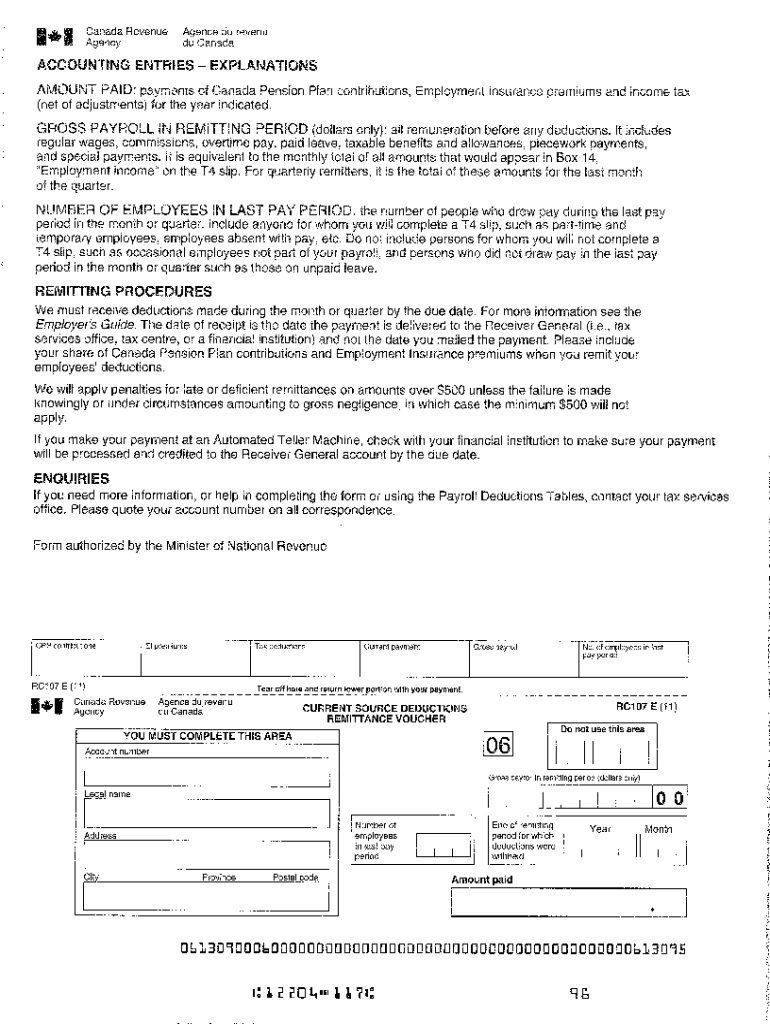

The PD7A form, also known as the payroll deductions remittance form, is a crucial document used by employers in the United States to report and remit payroll deductions to the Canada Revenue Agency (CRA). This form is essential for ensuring compliance with tax obligations, including income tax, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums. Employers must accurately complete and submit the PD7A form to avoid penalties and ensure that their employees' contributions are correctly accounted for.

Steps to Complete the PD7A Form

Completing the PD7A form involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect employee details, including names, Social Security numbers, and total earnings for the reporting period.

- Calculate deductions: Determine the total payroll deductions for each employee, including federal and state taxes, CPP, and EI contributions.

- Fill out the form: Enter the calculated amounts in the appropriate sections of the PD7A form, ensuring all figures are accurate.

- Review for accuracy: Double-check all entries for errors and ensure that all required fields are completed.

- Submit the form: Send the completed PD7A form to the CRA by the specified deadline, either electronically or by mail.

Legal Use of the PD7A Form

The PD7A form holds legal significance as it serves as an official record of payroll deductions made by employers. To ensure its legal validity, employers must adhere to the guidelines set forth by the CRA. This includes maintaining accurate records of employee earnings and deductions, as well as timely submission of the form. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid amounts.

How to Obtain the PD7A Form

Employers can easily obtain the PD7A form through various channels. The form is available for download in PDF format from the official CRA website, allowing for easy access and printing. Additionally, businesses can request physical copies through their local CRA office. It is essential to ensure that the most current version of the form is used to comply with any updates in tax regulations.

Form Submission Methods

The PD7A form can be submitted through multiple methods, providing flexibility for employers. The options include:

- Online submission: Employers can use the CRA's online services to submit the PD7A form electronically, which is often the fastest method.

- Mail: The completed form can be printed and mailed to the appropriate CRA address, ensuring it is sent well before the deadline.

- In-person: Employers may also deliver the form directly to their local CRA office, which can be beneficial for those who prefer face-to-face interactions.

Key Elements of the PD7A Form

Understanding the key elements of the PD7A form is essential for accurate completion. The form typically includes:

- Employer information: Name, address, and business number.

- Employee details: Names and Social Security numbers of employees.

- Deductions: Breakdown of federal and state taxes, CPP, and EI contributions.

- Total remittance amount: The total amount being submitted to the CRA for the reporting period.

Quick guide on how to complete cra remittance form

Complete Cra Remittance Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documentation, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without interruptions. Handle Cra Remittance Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign Cra Remittance Form effortlessly

- Locate Cra Remittance Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to send your form—via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tiresome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document administration needs within a few clicks from any device of your choice. Modify and electronically sign Cra Remittance Form to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cra remittance form

Create this form in 5 minutes!

How to create an eSignature for the cra remittance form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a pd7a form and why is it important?

The pd7a form is a crucial document used in Canada for reporting payroll deductions. It allows businesses to summarize employee income and deductions, ensuring compliance with tax regulations. Understanding the pd7a form is essential for maintaining accurate payroll records and avoiding potential penalties.

-

How can airSlate SignNow help with the pd7a form?

airSlate SignNow simplifies the process of preparing and sending the pd7a form by allowing you to securely eSign and manage documents online. With its user-friendly interface, you can quickly create, send, and track your pd7a form, ensuring timely submissions. This streamlines your payroll processes and saves valuable time.

-

What are the pricing options for using airSlate SignNow for pd7a form management?

airSlate SignNow offers various pricing plans designed to cater to different business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your requirements for managing the pd7a form efficiently. Pricing is competitive, and you can benefit from a free trial to explore the features.

-

Can I integrate airSlate SignNow with other software for pd7a form submissions?

Yes, airSlate SignNow provides seamless integration with various software applications, enhancing your workflow for pd7a form submissions. You can connect it with payroll systems and CRM applications, allowing for easy transfer of data and improving efficiency. This integration ensures that your documentation process is smooth and well-coordinated.

-

What features does airSlate SignNow include for managing the pd7a form?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and document tracking that make managing the pd7a form effortless. Its document storage capabilities ensure easy access and organization of your files. Additionally, you can collaborate with team members in real-time, enhancing productivity.

-

Is airSlate SignNow secure for handling sensitive pd7a form information?

Absolutely! airSlate SignNow prioritizes security and employs robust encryption protocols to protect sensitive information related to the pd7a form. Our platform is compliant with industry standards, giving you peace of mind that your data is safe. Regular audits and updates further strengthen our security measures.

-

How does electronic signing of the pd7a form benefit my business?

Electronic signing of the pd7a form streamlines the signing process, reducing turnaround times and boosting efficiency. It eliminates the need for printing, scanning, or mailing documents, saving both time and resources. Moreover, it enhances the overall experience for employees and clients, leading to improved satisfaction.

Get more for Cra Remittance Form

- Nyc 202 2015 form

- Name date period college information worksheet directions choose a college to research

- Decal nassau county form

- Lf606 criminal history txdmvgov txdmv form

- Union point steam academy re enrollment form upes greene schooldesk

- Nyc 3l 2016 form

- State of minnesota district court free divorce papers form

- Labor market research worksheet mass form

Find out other Cra Remittance Form

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement